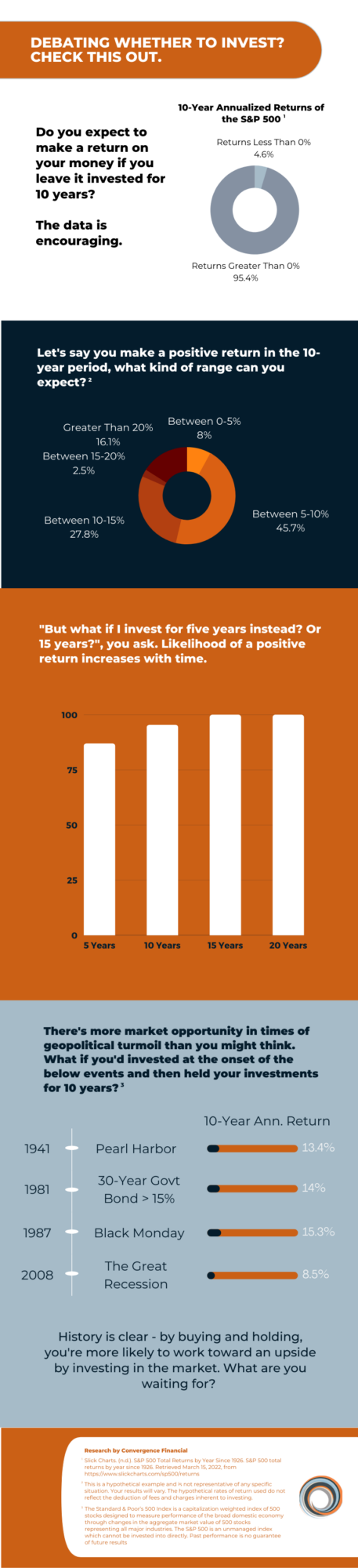

Visualizing the S&P 500

By Kelsey Lyman, Director of Operations, and Logan Clark, Assistant Investment Research Analyst

Investors have shown concern throughout the first quarter of 2022 regarding volatility in their portfolios.

“How will rising interest rates affect my portfolio?”

“Should we sell our investments in case the war in Ukraine escalates?”

During periods of market fluctuations and significant geopolitical events, our approach is to coach clients to stay invested and shy away from trying to “time” the market.

However, the numbers also tend to speak for themselves.

We took a look at the annualized returns of the S&P 500 over periods of five years and made comparisons to significant events and other statistics.

Here were some of our biggest takeaways:

- 71% of five-year increments yielded an annualized return greater than 5%. With full exposure to the S&P 500, a retiree could take the average withdrawal rate of 4% without eating into principal nearly 3/4 of the time!

- Only 13% of five-year increments yielded a negative annualized return.

Check out our infographic for more insights into the S&P 500!