Investing Discipline is Built During Downturns

By Kelsey Lyman, Director of Operations

“Volatility gets you in the gut. There’s no question that when prices are jumping around, you feel different from when they’re stable.” Peter Bernstein was an influential economist who identified strongly with the efficient market hypothesis (EMH). The hypothesis essentially states that all available information is reflected in asset prices – implying that no one can “beat” the market consistently. In this kind of environment, EMH proponents believe that investors do best when investing in low-cost passive portfolios. Regardless of the investing style, like Bernstein said, when market prices shift rapidly, it can cause investors to feel discomfort, question why they invested in the first place, and wonder if “this time” is the time that their account balance won’t come back. In this blog we’ll share historical market data on past drawdowns and volatility, address recession concerns and statistics, and discuss the attitudes to help avoid mistakes during periods of uncertainty.

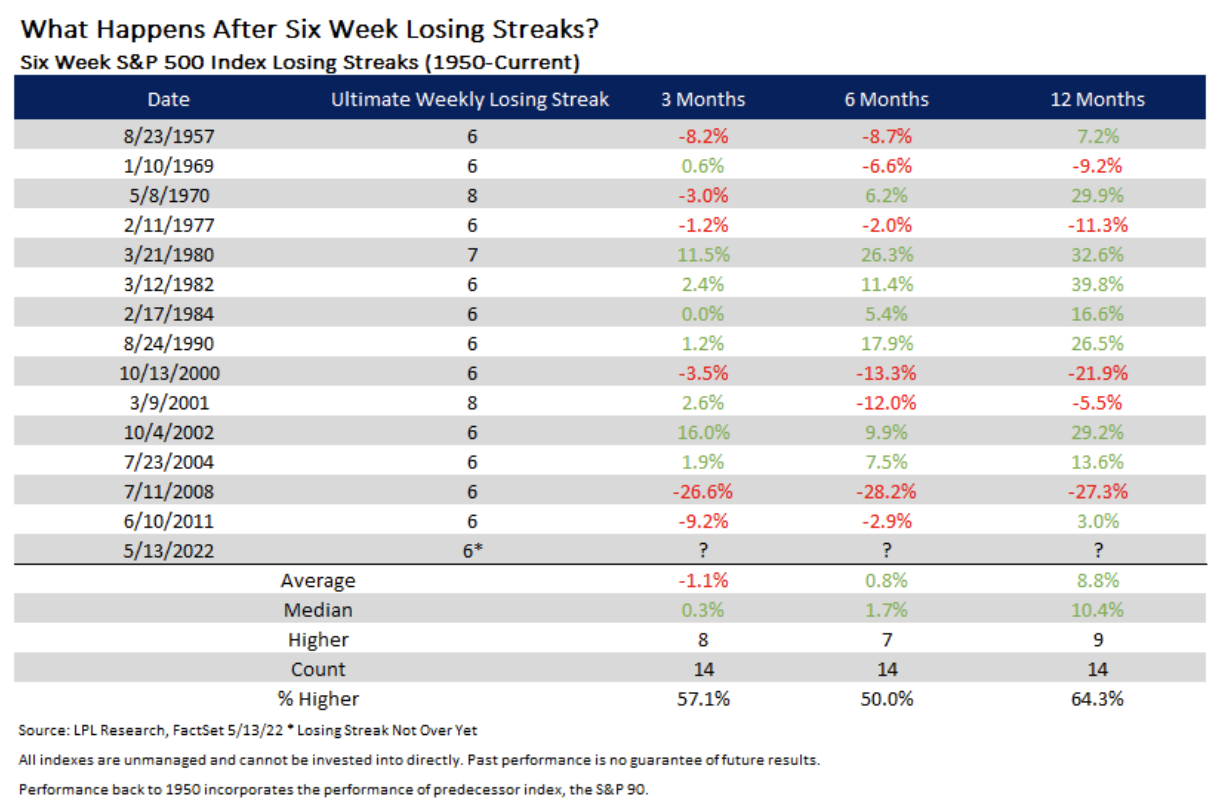

Periods Following Losing Streaks

Losing streaks occur every now and then, and the downward momentum that begins to build can feel intense and uncomfortable. However, historical performance of the S&P 500 shows that in the 12-month periods following six-week losing streaks have on average, yielded positive returns 64.3% of the time. For long term goals (greater than 12 months away), this implies that by staying invested through the losing streak for a year, the investor is more likely than not to come out on the other side closer to their goal.

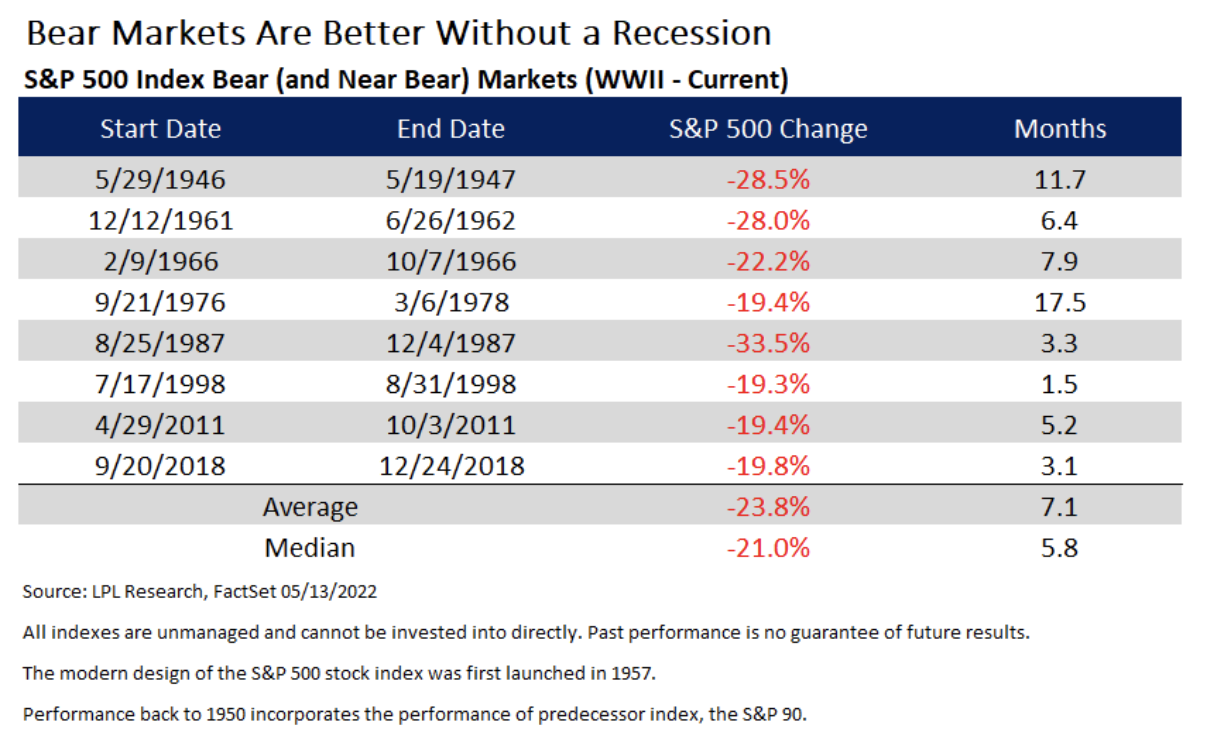

Bear Markets Without a Recession

Bear markets occur when markets drop greater than 20%, however, they don’t all coincide with recessions. Fortunately for investors, when bear markets occur without recessions, the average S&P 500 change is a negative 23.8%, not far beyond the bear market qualifying point. Since the economy is not yet in recession status, investors can look to past bear markets outside of recessions as a source of optimism.

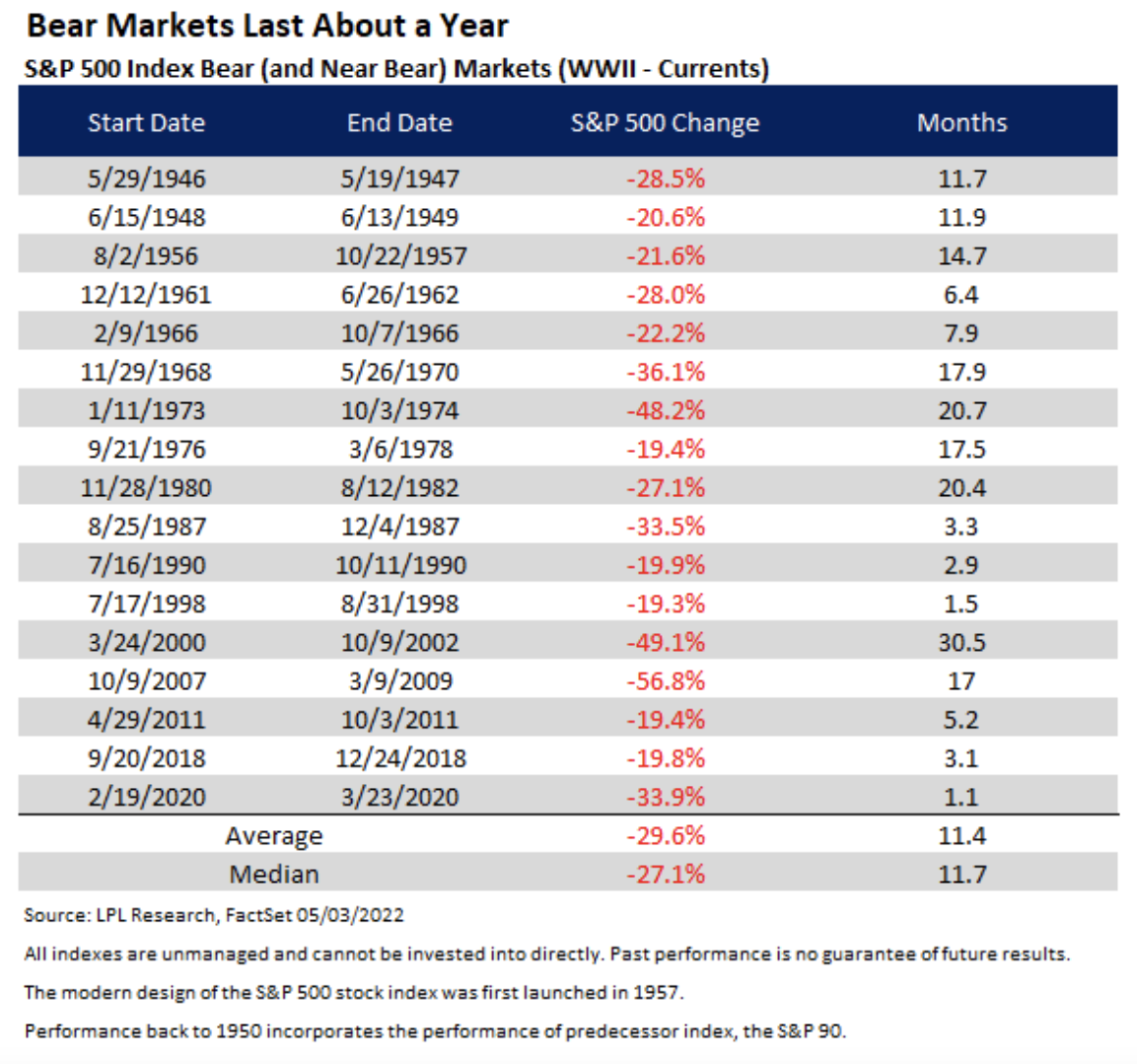

Bear Market Length

With or without a recession label, historical returns indicate that bear markets last for just under a year on average. The longest bear market occurred from October 9th of 2007 to March 9th of 2009, and the shortest from February 19th of 2020 to March 23rd of 2020. Again, while recoveries from bear market drawdowns may vary, the declines don’t last forever. With discipline, investors can still reach their goals.

Principles of Discipline

So yes, all the research presented above is reassuring in hindsight, but that doesn’t change any negative market movement and its psychological effects in the moment. The answer isn’t to simply feel better or ignore the market, but to lean on discipline in difficult times to stay rational and set the stage for the most favorable outcomes. Our firm’s investment philosophy is centered around the previously mentioned Efficient Market Hypothesis and its belief that it’s impossible to beat the market on a consistent basis. Our portfolios are constructed to capture the natural movement of the markets while limiting downside, and since markets have historically gone up over time, we act as behavioral coaches when things get difficult. Volatility tests fortitude and commitment to investing, which is what can make it challenging to stay invested when account balances begin to decrease. Here, we outline the attitudes and habits that help build the mental toughness of a seasoned investor.

- Asset Allocation. Attempts to time the market can open investors up to greater room for error. Not only does the timing of getting out of the market complicate things, but the decision on when to get back in can cause irreparable damage to portfolios if timed poorly. By investing funds into a predetermined strategic allocation and sticking to the strategy, investors are primed to take full advantage of market movement.

- Diversification. The old idiom of “don’t put all your eggs in one basket” rings true for investing. Many people know that it’s good to diversify their investments to get a sampling of a better return, but diversification works because it helps take risk off the table in addition to capturing more of the upside. When investors add “uncorrelated assets” into their portfolios (investments that react to market events differently than others), they can diversify out some of the risk inherent in their original investments. Add in more uncorrelated assets, and the effect increases. It’s impossible to diversify out all risk, but through careful portfolio construction, unnecessary risk can be taken out of the equation.

- Continuing Contributions. Returns are generated when the price a security trades at increases. When market drawdowns occur, security prices drop – effectively putting investments on “sale” (not unlike Black Friday deals). When investing for the long run, market downturns can result in excellent opportunities to acquire more shares for cheaper prices. Ultimately, this can result in improved returns over time. Younger investors with longer time horizons should actually prefer market declines for this reason. It’s important to stay consistent with portfolio contributions so that the most opportunistic part of the drawdown isn’t missed.

Periods of downturn and volatility in the markets are challenging and not something to be taken lightly. That’s why it’s even more important to educate on mistakes to avoid so that an already difficult time isn’t made worse. By creating a plan and having the discipline to follow it, investors can navigate through downturns with grace and hopefully come out having taken advantage of opportunities.