The Financial Planning Process

By Kelsey Lyman, Director of Operations

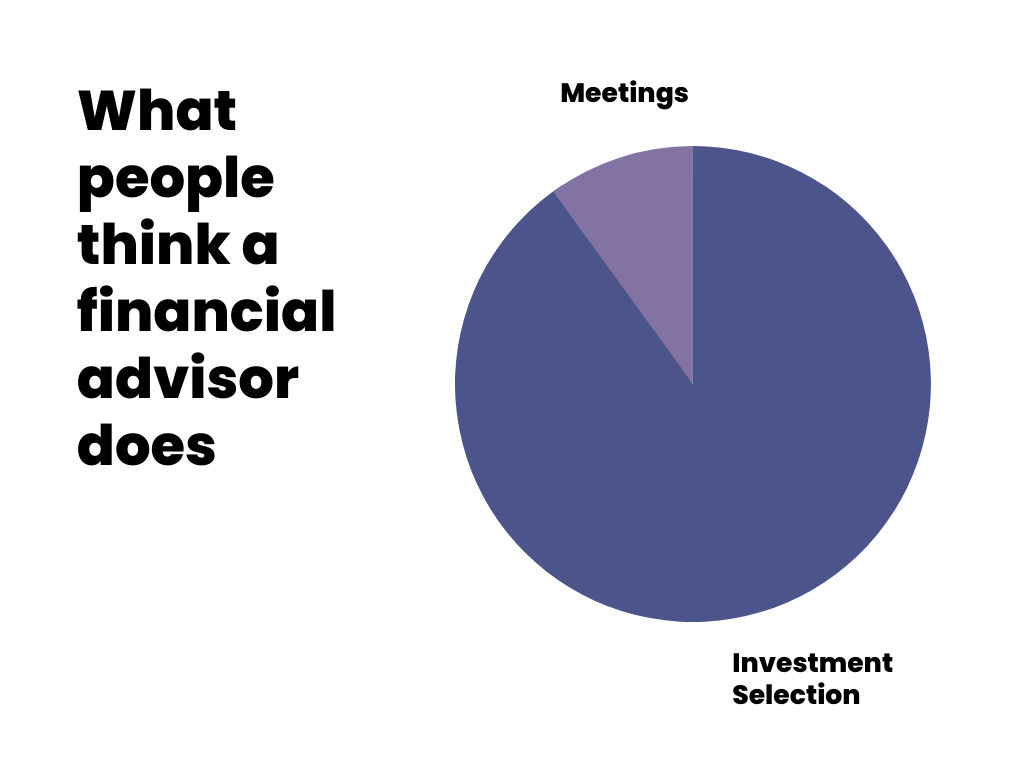

Most people probably think they know what a financial advisor does. Maybe they invest your money for you, provide counsel on how to manage your debt, and tell you when it’s okay to retire. To some degree, all of those things are correct, but what actually happens in a relationship with a financial advisor? There’s a lot more going on behind the scenes than you might expect. In this blog, we’ll cover the nitty gritty of how the financial planning process works.

First, the reality is that no client’s experience is exactly the same – which is a good thing. If doctors provided their patients with only one treatment plan, there’d be a lot of people whose ailments weren’t cured. Financial planning is the same in that the financial advice given to someone fresh out of college is likely to be vastly different than a 65 year old preparing to retire. There are many tools in the advisor’s toolbox, and it’s the advisor’s job to know which one to use in the right situation.

Throughout the blog, we’ll feature various themes that may come up for individuals at different stages of life:

- Beginning Investors – Young adults who may just be getting started in a career

- Mid-Career Investors – People in the thick of their lives, potentially with families or higher income jobs.

- Pre-Retirement or Currently Retired Investors – People who are planning for later life stages, estate planning, and the wealth distribution phase.

The First Meeting with a Financial Advisor

The first meeting with a financial advisor has a few goals. Most importantly, it’s the first opportunity to get to know each other and establish the foundation for the relationship. The advisor’s role in the first meeting is to listen and do their best to fully understand the client’s current financial situation and the goals they’d like to reach.

The client should be ready to share any and all financial information that’s relevant to their full financial picture. While it is very personal in nature, the financial plan is ultimately only as good as the inputs given, so it’s important to provide thorough and accurate information.

Items that may be reviewed in the first meeting include:

- All income and expenses

- Current debt (student loans, mortgages, car loans, credit cards, medical bills, etc)

- Current assets (houses, vehicles, businesses)

- Existing investments (IRAs, individual accounts, insurance policies, annuities, employer retirement plans)

- Goals (retirement, paying for kids’ college, starting a business, traveling, planned giving)

The advisor may ask more specific questions about things like future income needs, saving rates, tax brackets, and more. One of many roles a financial advisor plays is to know the client so well that they can anticipate what their needs will be. Are they savers who aren’t likely to need to withdraw funds? If so, maybe a long term growth investment strategy is appropriate. Are they spontaneous and might need $200,000 at a moment’s notice to start a new business? Depending on their needs, the advisor will decide on an appropriate investment strategy.

When the meeting ends, both parties should walk away with some action items. Usually for the client, it will be to gather any additional specific information to help the advisor formulate the plan. The advisor’s job in the meantime is to work with their planning and investment team to design the best financial recommendations based on the client’s personal situation.

Themes and Topics to Consider Based on Life Stage:

| Beginning Investors | Mid-Life | Pre-Retirement/Retirees |

|

|

|

Life Changes, Investment Management, and the Ongoing Relationship

After the desired direction of the financial plan is agreed upon, establishing and/or transferring accounts, and some financial plan execution, what happens next? Well, the financial planning process is never actually over. In fact, the plan should be reviewed and updated annually at a minimum, and more frequently than that if needed. Financial advisors deliver value in many ways, but one way that clients can get the most out of the relationship is by including their advisor in big decisions before they occur. There are many examples:

- “Which would be the best account to withdraw funds from to finance my home?”

- “Can we have an estate planning conversation with the whole family?”

- “What could my business be worth before I start discussing its sale with buyers?”

The other large piece of the financial planning process is ongoing investment management. It’s important to note that are many financial planners who aren’t skilled with portfolio management, and many asset allocators who do a poor job with financial plan development. Clients should choose a firm with both skillsets to increase the chances of achieving their goals.

Depending on the time horizon of your goals, your investments should be tailored to match. For example, a high-risk investment may not be suitable for people in or near retirement who are looking to their portfolio as a source of income. What if the investments took a sharp decrease in value? That would be counterproductive to a retiree’s goals. The opposite is also true – a young person with 30 years until retirement wants their retirement savings to grow, and a bond fund returning 3% is unlikely to outperform the S&P 500 over 30 years. This overly-conservative strategy would leave potential returns on the table and would be a waste.

Once investment accounts are open and funded with the firm, your financial advisor will discuss what mix of stocks, bonds, or other types of investments will comprise your account. Your advisor will also educate you on what level of volatility and returns are reasonable to expect from your portfolio. They can also cover any tax implications that your existing investments may have and how they plan to work through those with you.

Investment management is diminished without good planning, and planning is less effective without appropriate asset allocation following the plan’s implementation. Both are important pieces of financial success and should be emphasized in a long-term relationship with a financial advisor.

Themes and Topics to Consider Based on Life Stage:

| Beginning Investors | Mid-Life | Pre-Retirement/Retirees |

|

|

|

Hopefully this walkthrough of the financial planning experience has set expectations for working with a financial advisor. Almost anyone can benefit from a little help with planning. If nothing else, advisors bring a lot of value to the table simply by working with their clients on to-do items so that they can make tangible progress toward their goals.

Planning is much more than just picking stocks and bonds, and clients should know exactly what they need to do next to reach their goals after visiting their financial planner. If you’re ready to track your progress toward your goals and have a relationship with a professional who will be an accountability partner, it might be time to visit with a financial advisor.

The opinions voiced are for general information only and are not intended to provide specific advice or

recommendations for any individual. All investing includes risks, including fluctuating prices and loss of principal.? No strategy assures

success or protects against loss.