What We Can Learn from the Employees of Enron and WorldCom: Concentrated Stock Risk

By Kelsey Lyman, Director of Operations

The collapse of both Enron and WorldCom in the early 2000s caused estimated losses of $1.5 trillion in the retirement accounts of both companies’ workers. Fraudulent reporting activity led to plummeting share prices for both companies, and devastated retirement hopes for thousands of workers who had invested high proportions of their portfolios in the stocks. In response, congress passed legislation shortly thereafter with the goal of regulating company reporting activity and protecting investors, although that’s done little over the years to discourage individuals from accumulating high concentrations of a single stock in their portfolios. While employer stock options and other equity incentives are attractive to employees, it’s important to consider the potential hazards of having significant portions of net worth invested in one company. In this blog, we’ll review what constitutes a concentrated position, the impact that volatility and poor performance can have on a portfolio, and why a diversified approach can help investors better manage risk to achieve their goals.

During the Enron and WorldCom scandals, many employees lost everything because their entire net worth was fully invested into their employer’s stock. This isn’t often the case with most people who hold shares of their employer’s stock, but holding a large proportion relative to your entire investment portfolio can still be a cause for concern. A concentrated position is typically defined as 10% or more of a portfolio allocated to one investment. Standard “diversified” portfolios are made up of 10-15 different investments with exposure to multiple asset classes, a defined strategy, and a target risk metric that aligns with the investor’s goals. Since risk can be reduced through diversification, investors should do so in a way that doesn’t take on more than they’re comfortable with. Even if an individual investor works for a great company with significant growth potential, caution should still be taken to avoid “over-investing” in one institution alone. Here are some concepts to consider:

Full Financial Picture Impact

A concentrated position in an employee’s own company brings increased risk due to how much of the financial picture is also tied up in the investor as an employee. Not only is the investment portfolio fully dependent on the company’s ability to grow and produce returns, the investor’s income is also dependent on the company as well. If the company were to shut down, the income and the savings of the employee could be put in jeopardy.

Potential for Below-Market Returns

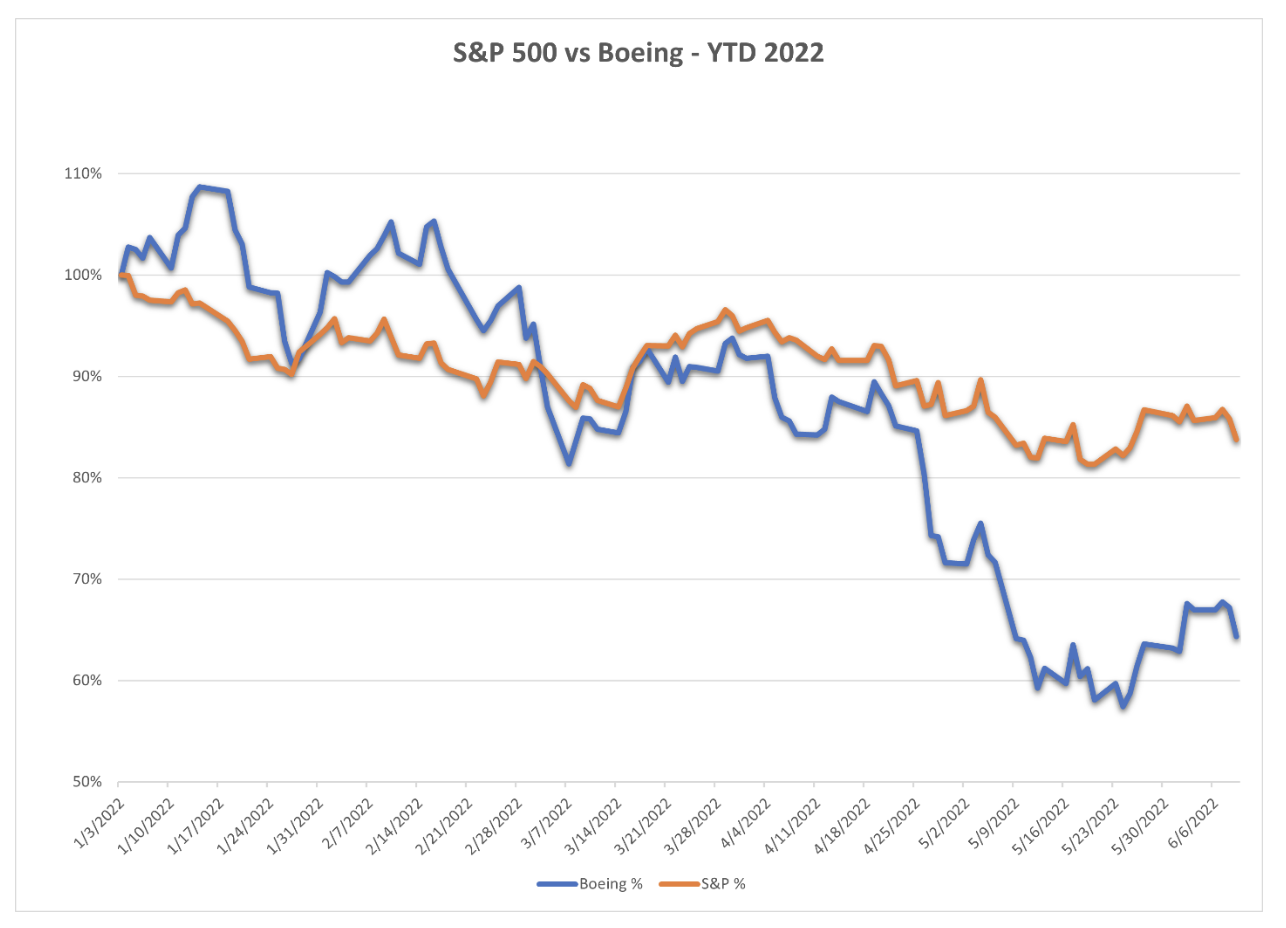

There can be excitement and hype around the growth potential for the company, which makes employees feel like owning more shares will guarantee a comfortable retirement. However, when times get tough in the economic environment, some companies perform worse than others simply due to the cyclicality of their business or the industry they’re in. A 2022 example of this is Boeing. Boeing’s worst day of 2022 was May 24th, where the share price dropped a whopping 47.16% below where it had started the year. The S&P 500 was also down on that same day, but only at a 17.83% decrease from the beginning of the year – considerably less than what Boeing experienced. To put it into dollar terms, in a $100,000 investment account, the difference of $29,330 is substantial, and a 100% allocation to the S&P 500 would have left the individual better off on Boeing’s worst day than an investor with 100% allocated to Boeing.

Bear Market Length

With or without a recession label, historical returns indicate that bear markets last for just under a year on average. The longest bear market occurred from October 9th of 2007 to March 9th of 2009, and the shortest from February 19th of 2020 to March 23rd of 2020. Again, while recoveries from bear market drawdowns may vary, the declines don’t last forever. With discipline, investors can still reach their goals.

NYSE. (2022, January 1). Boeing Co, S&P 500 [Chart]. Retrieved June 6, 2022 from https://www.marketwatch.com/investing/index/spx and https://www.marketwatch.com/investing/stock/ba

Missing out on the Upside

Even if a company is performing well, it can still be left behind by other companies that are doing better. One of the benefits of pooled investments like mutual funds is that the investments are dispersed across many different companies, not just one or a few. By not “putting your eggs in one basket” the returns the fund can achieve are stabilized by the diversity of the investment. Protecting from the downside is very important, however, it’s not ideal to leave gains on the table if they can potentially be achieved without taking on additional risk.

So, how can one restructure their portfolio to remove risk and hopefully achieve better returns? Diversification. This doesn’t imply that the whole position should be liquidated immediately, however, because there are often significant tax consequences which should be carefully considered. But the fact remains, an investor can control a greater amount of risk and return potential through the end goal of building a diversified portfolio. The willingness of employers to reward employees with shares can be highly appealing and deliver additional value, but it’s important to consider all the impacts it can have on the bigger financial picture.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.